Unlock the future of the cybersecurity ecosystem

Cyber-attacks continue to expose weaknesses in cybersecurity defenses, causing significant disruption worldwide. Organizations are proactively investing more, but according to the latest Canalys estimates, enterprise spending on cybersecurity still accounts for less than 5% of total IT budgets.

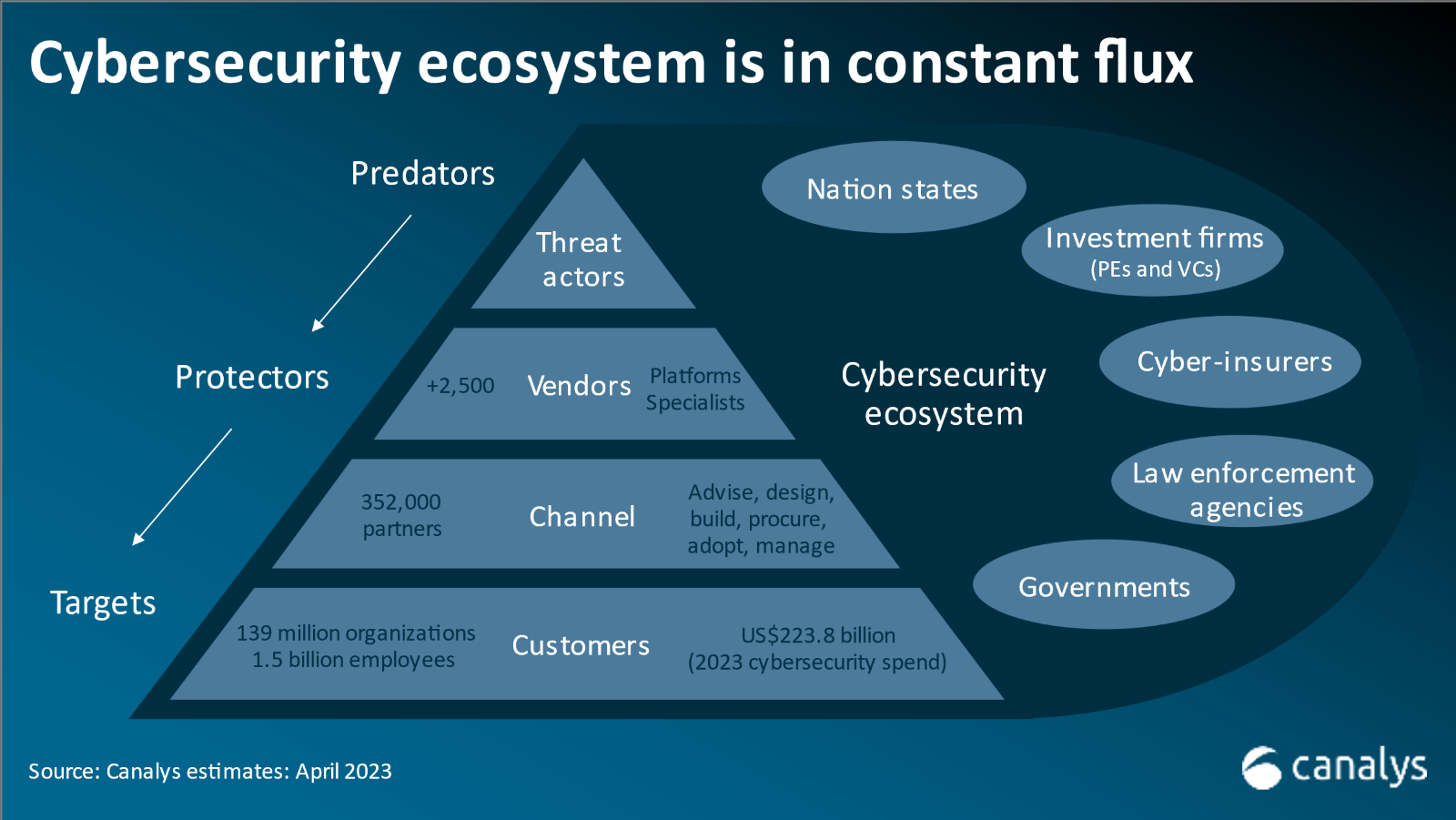

The cybersecurity ecosystem is broad and dynamic. It consists of different but interrelated components, including threat actors, technology vendors, investment firms, channel partners, customers, cyber-insurers, law enforcement agencies and government bodies that operate in a framework of strengthening regulations. The balance between these components is constantly changing.

In this 15-page complimentary report, Canalys combines in-depth research in both cybersecurity and channels to lay out five trends set to impact the cybersecurity ecosystem landscape in 2023.

This in-depth analysis is the key to understanding the ever-evolving cybersecurity scene, outlining the looming risks and emergent opportunities for vendors and channel partners. It covers:

- The evolving threat landscape

- Cybersecurity platform success

- Managed services adoption

- Cybersecurity channel growth driven by new vendors

- The emerging AI battleground

Get the report delivered to your inbox to gain insights to reshape your cybersecurity strategy in 2023.

Why read this complimentary cybersecurity report from Canalys?

According to Canalys’s continuous global data and research, cybersecurity will remain one of the fastest-growing sectors of the tech industry in 2023, as organizations prioritize spending on improving defenses and adding new detection and response capabilities. Global cybersecurity spending (including technology and services) will rise by 13% to US$223.8 billion this year.

But cybersecurity will not be fully immune to the fallout from the turbulence affecting customers’ businesses, despite heightened threat levels. War and geopolitics, rising interest rates, persisting high levels of inflation, currency fluctuations, economic slowdown, extreme weather events, and natural disasters, as well as political instability, are the notable known factors currently affecting operations and general confidence. Recent banking collapses and corporate takeovers have caused further uncertainty, while other unforeseen events will no doubt emerge this year, resulting in even more disruption.

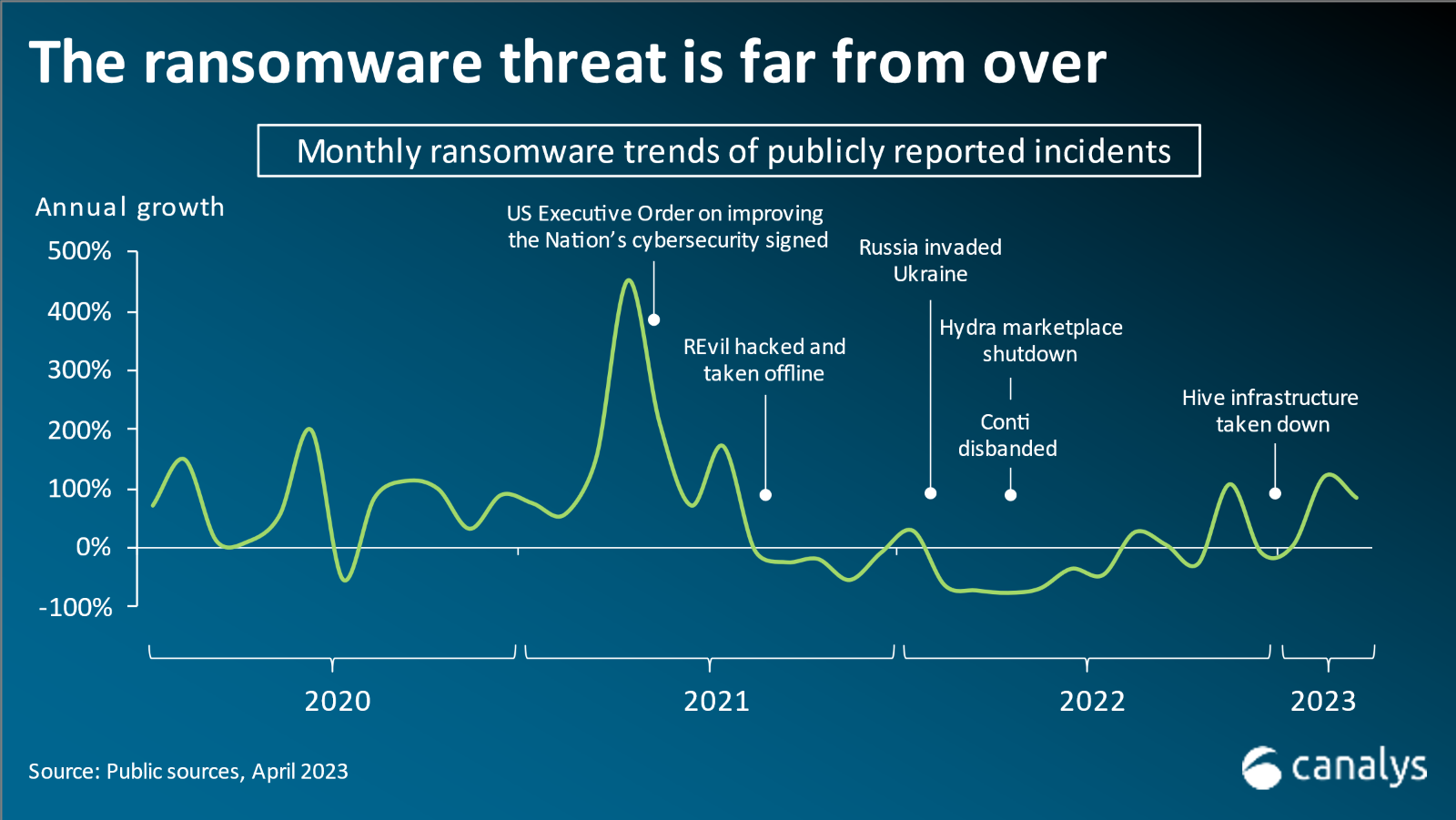

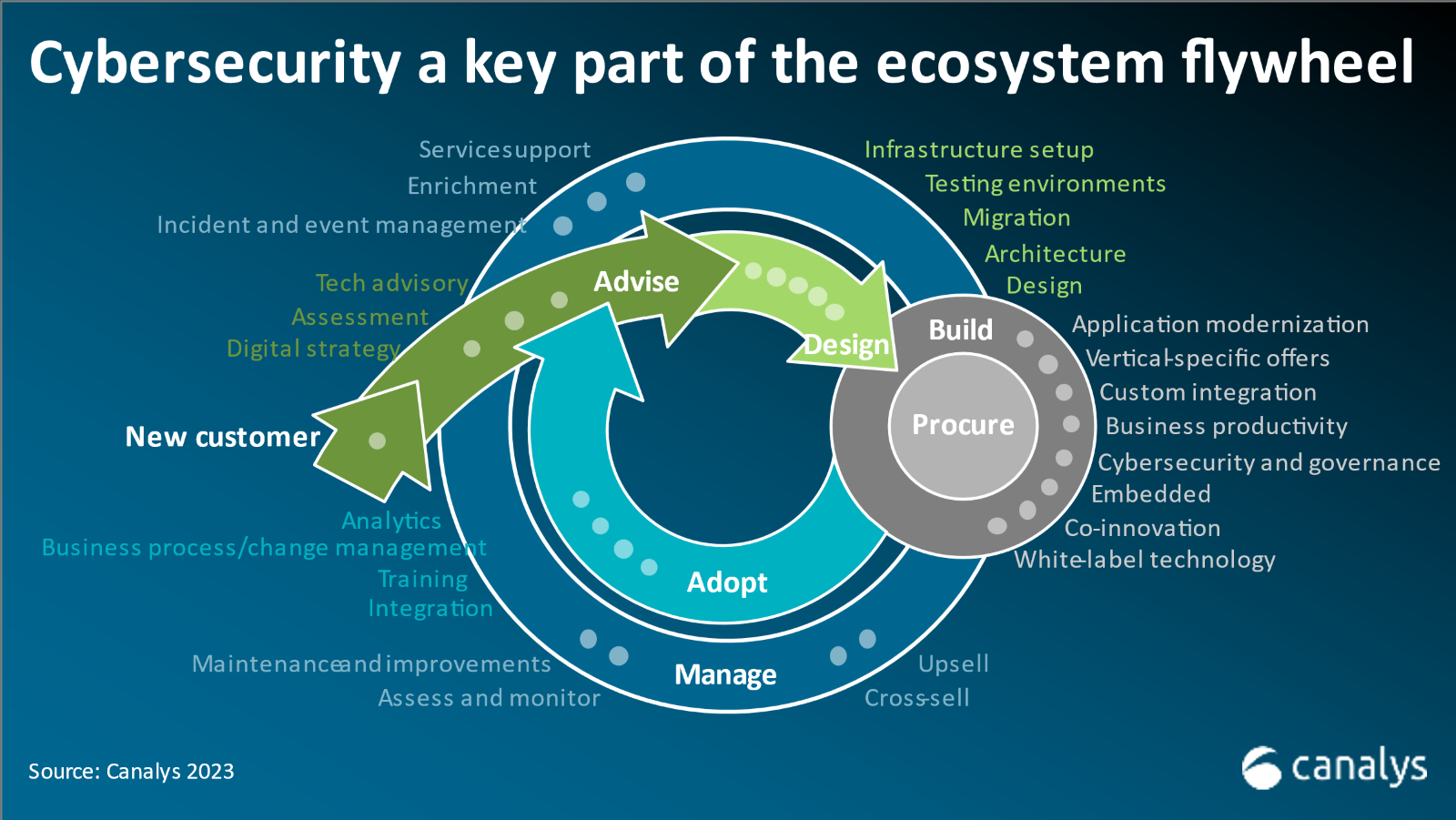

Risk levels remain high as threat actors regroup, exploiting vulnerabilities. With cybersecurity-managed services outpacing technology deployments, understanding the diverse capabilities across the partner landscape is critical. Canalys estimates that over 90% of the US$223.8 billion cybersecurity spend (on technology and services) in 2023 will go through the partner community.

This complimentary report provides a comprehensive insight into:

- The broad cybersecurity ecosystem, encompassing threat actors, technology vendors, investment firms, channel partners, cyber-insurers, law enforcement agencies and government bodies operating within the framework of tightening regulations.

- The ongoing fight against ransomware, a threat that continues to evolve as new actors emerge and threat groups repurpose tools for targeted attacks.

- The highly disruptive fallout from successful cyber-attacks on high-profile firms and organizations, underscoring the need for robust cybersecurity measures.

- The dynamics of cybersecurity channel competition, especially with nearly 50 highly funded pre-IPO vendors investing in their programs for accelerated expansion.

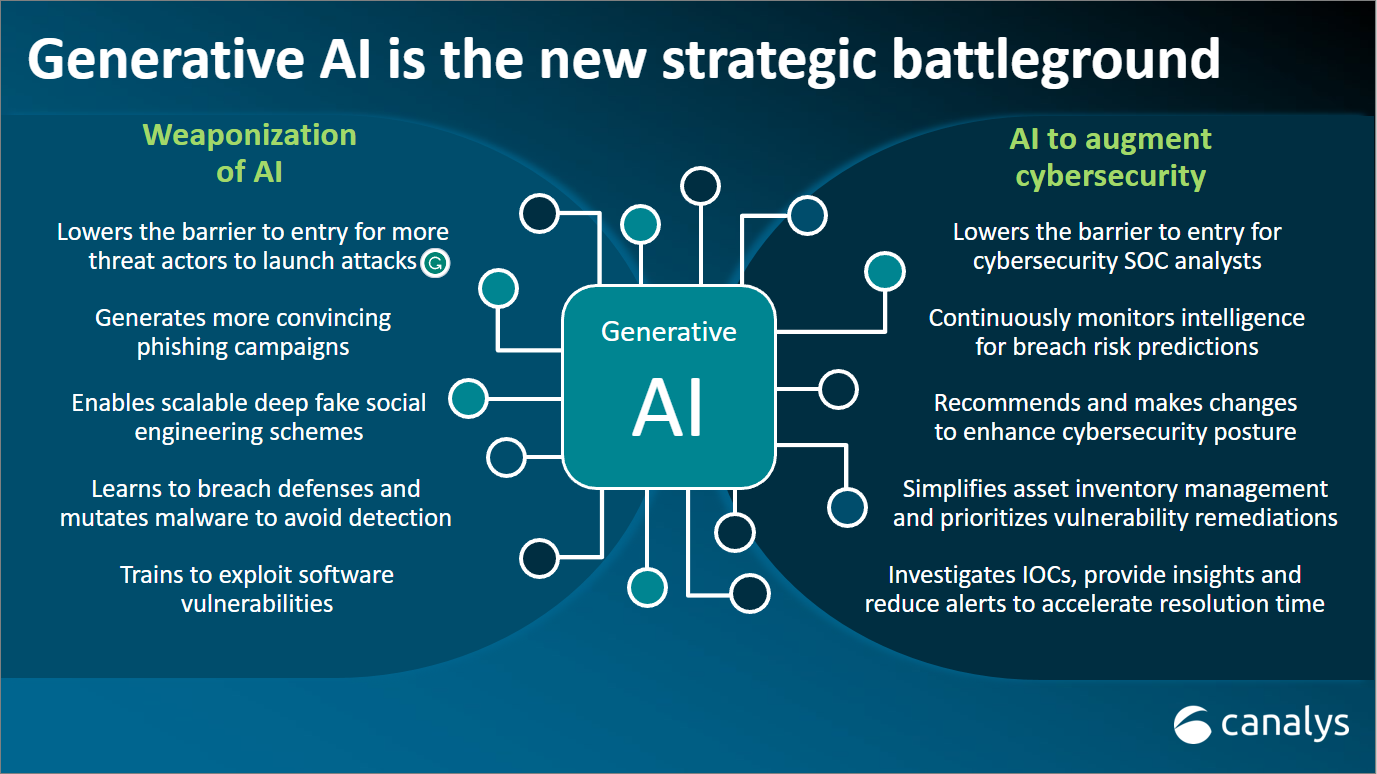

- The transformative potential of generative AI within the cybersecurity ecosystem, empowering organizations to enhance their cybersecurity capabilities while presenting new opportunities for threat actors.

- The role of cybersecurity startups in driving innovation, underpinned by venture capital funding that enables the development of new technologies and strategies.

The report talks about opportunities for the 16 Canalys Cybersecurity Titans (the largest publicly quoted vendors that publish quarterly cybersecurity revenue) and Microsoft (which is excluded from the Titans as it does not report its cybersecurity revenue on a quarterly basis).

This report not only highlights the shifting cybersecurity landscape but also explores strategies to respond effectively to these changes. It emphasizes the importance of understanding differing partner capabilities and illustrates the potential upsell opportunities for cybersecurity vendors with platform strategies.

Your next step

As cybersecurity threats evolve and new actors emerge, staying informed is not a choice, but a necessity. Gain the knowledge you need to prepare for "Now and Next" in the cybersecurity ecosystem landscape in 2023. Click below to get the complimentary report delivered via email.

Canalys Cybersecurity Titans

Pre-IPO cybersecurity vendors